Bankrupt, its assets are sold and these funds are used to settle its debts first. Only after debts are settled are shareholders entitled to any of the company’s assets to attempt to recover their investment. The 25 accounting practices with the highest revenue growth in percentage terms in 2022 from Accounting Today’s Top 100 and Regional Leaders list. From 2007, when Joseph aged 14 began training in earnest, the family split their time between Singapore and the US. Since winning his gold medal, Joseph has continued to train in the US and regularly competes in college swim competitions, smashing records in the process, while studying at the University of Texas in Austin.

Female membership a hundred years ago was laughable; however, Smith eventually forced her way in, opening the door for many other women to follow her and break down the barriers deterring female applicants. Winston Hall established the scholarship in honor of Louise’s memoryLouise Hall didn’t slow down until her late 80s, but even then, she didn’t fully step away from the business until her mid-90s. Now retired himself, Winston Hall created the Louise Rackley Hall and Winston T. Hall Scholarship to honor her legacy. Once fully funded, it will provide need-based scholarships for Poole College of Management students pursuing an undergraduate degree in accounting. Also to honor his mother, Winston Hall asked that preference be given to students who have demonstrated interest in equity, diversity or social justice for women.

Under the cash method of accounting, a journal entry is only recorded when cash has been exchanged for inventory. There is no entry when the order is placed; instead, the company enters only one journal entry at the time the inventory is paid for. The entry is a debit to inventory for $1,000 and a credit to cash for $1,000. Financial accounts have two different sets of rules they can choose to follow. The first, the accrual basis method of accounting, has been discussed above.

An accounting method consists of the rules and procedures a company follows in reporting its revenues and expenses. The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business. This information is then used to reach decisions about how to manage the business, or invest in it, or lend money to it. The framework that a business makes use of relies upon upon which one the recipient of the financial statements desires. Thus, a European investor may want to see financial statements based mostly on IFRS, whereas an American investor might wish to see statements that comply with GAAP.

One thing that Luca Pacioli is very blunt about, is that accounting is hard work. Here are just a few examples of accountants who started companies and made their mark in the business world. Lenders like banks take a look at the accounts before they lend money to the corporate. Tax authorities have a look at them to examine that the corporate is paying the correct amount of taxes. Accounting or accountancy is the job of sharing monetary details about a business to managers and shareholders . GAAP is a mixture of authoritative standards and the commonly accepted methods of recording and reporting accounting data.

Types of Consolidation Accounting

In financial parlance, the terms bookkeeping and accounting are almost used interchangeably. While bookkeeping is all about recording of financial transactions, accounting deals with the interpretation, analysis, classification, reporting and summarization of the financial data of a business. The management function has become more complex because of the increased scale of business operations. Hence, there are specialised branches in accounting to handle this situation.

Calendar quarters such as January 1 through March 31, April 1 through June 30, etc. Pacioli was one of the great compilers of his time, producing works that were summaries of the knowledge of his contemporaries. That he borrowed heavily from others to produce his works is not unprecedented among those who wish to bring the gems of knowledge to a wider audience, and certainly this was his aim. The first printed illustration of a rhombicuboctahedron, by Leonardo da Vinci, published in De divina proportione. Leonardo was so impressed with the Summathat he persuaded his patron, Lodovico Sforza, to invite Pacioli to teach mathematics at the court of Milan.

May Schooling, professional accountant and mother of Olympic medallist

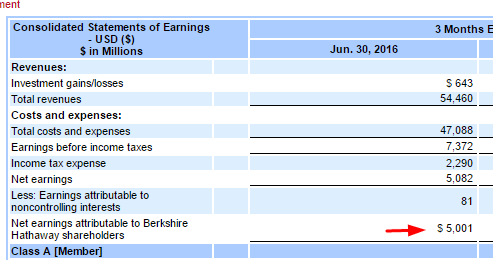

In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance. In the full consolidation method, the parent balance sheet records the subsidiary assets, liabilities, and equity. Besides, all the subsidiary revenues and expenses are transferred to the income statement of the parent.

- Banks and other lending institutions will often require financial statements in compliance with accounting rules as part of the underwriting and review process for issuing a loan.

- This method would show a prospective lender a much more complete and accurate picture of the company’s revenue pipeline.

- Be your own Money Doctor MD and be financially well off, by learning the accounting tools and learning how to save.

- As you can see, shareholder’s equity is the remainder after liabilities have been subtracted from assets.

- Corporations, nonprofits, organizations and governments use administration accountants to document and analyze monetary data of the businesses in which they are employed.

- INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

For example, if a painter completed a challenge on December 30, 2003, however doesn’t get paid for it until the owner inspects it on January 10, 2004, the painter reports those money earnings on her 2004 tax report. In cash-basis accounting, money earnings include checks, credit-card receipts, or some other form of revenue from customers. Corporations, nonprofits, organizations and governments use administration accountants to document and analyze monetary data of the businesses in which they are employed. They usually advise firm executives, creditors, stockholders, regulatory agencies and tax personnel. Accountants may work with government officials who are inspecting and sustaining the monetary information of the non-public business for whom an accountant is employed, in reference to taxation and government rules.

External investors want confidence that they know what they are investing in. Prior to private funding, investors will usually require financial statements to gauge the overall health of a mother of accounting company. Banks and other lending institutions will often require financial statements in compliance with accounting rules as part of the underwriting and review process for issuing a loan.

The consolidation process in accounting brings together financial aspects of subsidiary branches with their mother branch. This transaction affects only the assets of the equation; therefore there is no corresponding effect in liabilities or shareholder’s equity on the right side of the equation. And she had to excuse all of her guests to say that she had to go back to work, cuz she got permission to take the day off. If you are a mother and you wanna, um, you know, take care of your family and be available to your family, this type of culture, this type of value set is simply not an alignment.

Business decisions may range from deciding to pursue geographical expansion to improving operational efficiency. Accounting can be classified into two categories – financial accounting and managerial accounting. The main goal of accounting is to accurately record and report an organization’s financial performance. The Securities and Exchange Commission has an entire financial reporting manual outlining reporting requirements of public companies.

Cash Method vs. Accrual Method of Accounting

The results of all monetary transactions that occur throughout an accounting period are summarized into the steadiness sheet, revenue assertion, and money circulate statement. The financial statements of most firms are audited yearly by an exterior CPA agency. For some, similar to publicly traded companies, audits are a legal requirement. However, lenders also typically require the outcomes of an external audit yearly as a part of their debt covenants. Accounting is the process of systematically recording, measuring, and communicating information about financial transactions.

By John Freedman The SEC holds chief executives liable for proper disclosure on financial statements. Accounting is a term that describes the process of consolidating financial information to make it clear and understandable for all stakeholders and shareholders. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Generally speaking, however, attention to detail is a key component in accountancy, since accountants must be able to diagnose and correct subtle errors or discrepancies in a company’s accounts.

Tax Accounting

It also facilitates the comparison of financial information across different companies. GAAP may be contrasted with pro forma accounting, which is a non-GAAP financial reporting method. Internationally, the equivalent to GAAP in the United States is referred to as international financial reporting standards . IFRS is followed in over 120 countries, including those in the European Union . Small companies that may be looking to be acquired often need to present financial statements as part of acquisition or merger efforts.

A person of deep dedication to the causes she has chosen, Schooling keenly felt the challenge of getting members to be more active and passionate about supporting the local ACCA community. ‘When I started in this industry, we didn’t use computers,’ Schooling reminisces. ‘But with the current state of media and connection across the world, one really has to be aware of technology and keep up to date with developments in things such as big data. The first woman to attain CPA licensure in the United States, Christine Ross passed the CPA exam in June of 1898. However, it took a year and a half to receive her certificate when the New York Board of Regents finally decided to allow women to be granted one on December 21, 1899. She practiced from her New York City office early in the 20th century; her clients included people working in the business and fashion industries, as well as wealthy women.

Tax accounts may also lean in on state or county taxes as outlined by the jurisdiction in which the business conducts business. Foreign companies must comply with tax guidance in the countries in which it must file a return. This institute created many of the systems by which accountants practice today. The formation of the institute occurred in large part due to the Industrial Revolution.

What is Accounting?

The three major financial statements produced by accounting are the income statement, the balance sheet, and the cash flow statement. Financial accounting is primarily concerned in processing historical data. Business transactions are events that have a monetary impact on the financial statements of an organization.

‘Stress is part of life; we cannot protect our children from everything,’ she says. ‘Technology has helped to ease and speed things up, but the irony is that communication has been whittled down in our family units. Familial ties teach us about loyalty and communication, besides teaching us indirectly the ways to multitask well. She adds that splitting the family was not an easy decision to make but one that gave her son the strength to go for gold while knowing he had the support of his parents in his endeavours. That history shapes our values and sense of stewardship today, informing our commitment to our clients, our colleagues, and the future.