Content

- Cryptocurrency Exchange

- What To Look For In A Cryptocurrency Exchange?

- Best Crypto Exchanges

- Different Types Of Cryptocurrency Investing

- Advantages Of Centralized Cryptocurrency Exchanges

- How Do I Open A Crypto Exchange Account?

- Comparing Crypto Exchange Platforms

- What Are Privacy Coins? Everything You Need To Know

Firstly, this helps create a place from which fiat currency can be sent and received. Secondly, it helps verify a person’s identity and credibility. To protect your crypto, some exchanges have insurance policies to protect the digital currencies users hold within the exchange from hacking or fraud. Coinbase, for example, has an insurance policy worth $255 million. That means if Coinbase’s reserves were hacked and any amount of crypto up to $255 million was taken, account holders would be protected.

Remember trade types involving the latter are still evolving in the U.S., so different exchanges’ offerings may vary over time. Many exchanges charge fees to withdraw coins from their platform. This can be an issue if you prefer to move your crypto to a secure third-party wallet or onto another exchange. For each ranking, the sum of weighted values across all or some of these key factors was calculated to award each brokerage or exchange its overall rank. Margin trading, platform lending and advanced trading were not considered for choosing the best crypto exchanges for beginners. Some crypto exchanges allow users to lend out their cryptocurrency.

Cryptocurrency Exchange

Account-based features like device restriction, address whitelisting and two-factor authentication make it incredibly hard for malicious actors to compromise your Binance account. If you have a Binance account, here’s how to secure your Binance account with two-factor authentication. Whether big or small, the size of a crypto platform or its security strategies wouldn’t deter hackers from coming for it. In 2020, the popular Seychelles-based crypto exchange platform, KuCoin, lost $281 million in a hack.

However, for this strategy to work, it’s very important to seize this rare chance immediately before the exchange’s algorithm promptly fills the price gaps. Traders can use DEX to set up trading pools between any two cryptocurrencies. By using three distinct trading pools, a trader can swap currency X for currency Y, then Y for currency Z, and lastly, Z for X. https://xcritical.com/ The core principle of trading on centralized exchanges is that the latest bid-ask paired request on the exchange order book determines how much an asset will cost. To understand what cryptocurrency arbitrage is, we are first introducing the concept of arbitrage. Imagine that you’ve just bought a pencil for $10, which you then sold to someone else for $11.

But like we hear from experts time and again when it comes to crypto, taking the time to learn as much as you can before you put money into crypto is one of the most useful things you can do. If you plan to buy, sell, or trade your crypto, the exchange you choose should have enough trade volume to ensure your holdings are relatively liquid, meaning you can sell them when you want. Often, the more popular exchanges are also those with the largest trade volumes. Bittrex is a platform for anyone looking for a large variety of cryptos — it offers over 190 of them. Founded in 2014, Bittrex believes security is key to a good exchange platform. It’s also user-friendly, making it a good platform for beginners.

What To Look For In A Cryptocurrency Exchange?

Once you have your money in the account, you can begin to invest. Before investing in crypto, you need to make sure that you have a solid financial foundation. This means having an emergency fund that covers three to six months of living expenses, contributing to your retirement accounts, and paying down debt. Cryptocurrency investments are high risk, and you should invest only what you can afford to lose. Therefore, it is simpler to buy or sell cryptocurrencies in a liquid market since more market participants mean that buy or sell orders will filled more rapidly. Essentially, this means that, given the brisk nature of the cryptocurrency markets, a deal can entered or exited at any time.

The value of virtual currencies is based primarily on the trade volume, which is the cornerstone of crypto arbitrage and the primary reason for variable prices on various exchanges. To get started with this undertaking, they use a cryptocurrency exchange platform for their trading efforts. Verify the database of assets to see if cryptocurrencies and other digital assets you want to trade are included. Coinmarketcap, some of the most popular decentralized crypto exchanges are MDEX, Uniswap, PancakeSwap, JustSwap, etc. Thus, it is important that when deciding to invest in cryptocurrencies you need to be sure that you are using a legit cryptocurrency exchange.

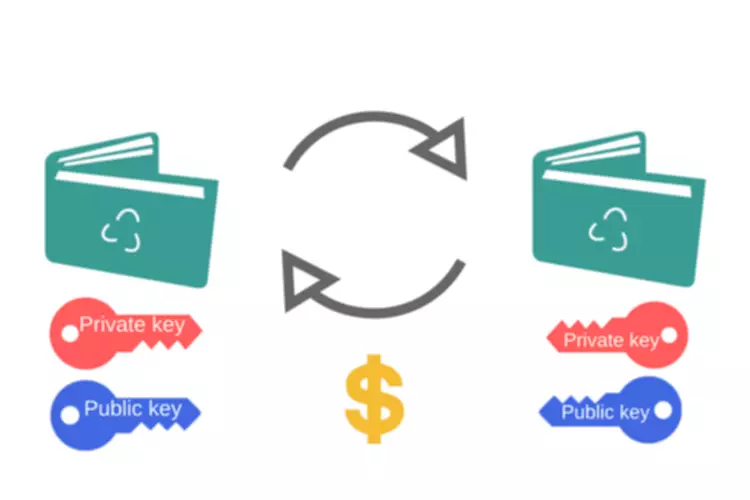

To open an account, most cryptocurrency exchanges require you to provide your name, email, personal information, and proof of identity . This process may include answering personal questions, verifying your identity with a third-party application, or providing a picture of your driver’s license. Once you purchase crypto through an exchange, the exchange typically holds it in a custodial wallet. Most exchanges store assets in offline “cold storage” for safekeeping. If you want to take custody of the cryptocurrency yourself, most exchanges allow you to transfer it to your “hot” or “cold” wallet, along with the private keys for that cryptocurrency. However, for experienced crypto investors who prefer to trade on a decentralized, KYC-free platform, Bisq offers everything you need to buy and sell cryptocurrency.

In addition to spot trading, Kraken users can also trade cryptocurrency using margin and execute crypto derivatives trading strategies. Founded in 2017, BitMart is a global cryptocurrency exchange that’s available in over 180 countries. It allows users to buy, sell, and store over 1,000 digital currencies and tokens. Gemini offers over 40 cryptocurrencies and is a good platform for beginners as well as avid traders. Although it has a simple interface, Gemini also offers upgrade features and tools for advanced trading. Launched in 2015, the platform is transparent about its security measures and stores the cryptocurrencies in an offline cold storage system.

They differ significantly from day traders, who rely on accurately predicting crypto prices. The conventional methods of generating profit from crypto trades are complicated and require adequate experience and a maturation period. The funds allow members of the public to purchase and hold cryptocurrencies through the fund. This type of platform offersP2Ps trading between sellers and buyers. In other words, buyers and sellers deal directly and not through an exchange platform.

Best Crypto Exchanges

This platform offers a solid range of coins with very competitive trading fees. It’s also one of the few exchanges in the U.S. to offer margin trading and a suite of other advanced trading tools like advanced order types and futures trading. Another benefit of developing a cryptocurrency exchange is the ability to offer 24/7 trading. This is possible because cryptocurrencies are not subject to traditional financial regulations. As such, exchanges can operate on a 24/7 basis without having to worry about traditional market hours or holidays. This is a major benefit for users as it allows them to trade whenever they want.

For example, Bitcoin mining currently consumes electricity at an annualized rate of 127 terawatt-hours , which exceeds Norway’s entire annual electricity consumption. I’m the deputy editor of Investing & Retirement at Forbes Advisor. I’m pretty familiar with the investing beat, having served as the former assistant managing editor of Investing at U.S. News & World Report, where I also launched several newsletter products. My work has appeared in TheStreet, Mansion Global, CNN, CNN Money, DNAInfo, Yahoo Finance, MSN Money, and the New York Daily News. I’m an alumna of the London School of Economics and hold a master’s degree in journalism from the University of Texas at Austin.

Centralized exchanges make it easy to get started with cryptocurrency trading by allowing users to convert their fiat currency, like dollars, directly into crypto. The vast majority of crypto trading take place on centralized exchanges. Some crypto exchanges support advanced trading features like margin accounts and futures trading, although these are less commonly available to U.S.-based users.

Your location may prevent you from buying and selling crypto on certain exchanges due to state or national regulations. Some countries, like China, have banned citizens from accessing crypto exchanges at all. Just like investing in stocks, whenever you make capital gains while trading cryptocurrencies, you how to create a cryptocurrency exchange have to report it in your taxes. Some platforms provide you with Form 1099-B, which tracks your gains and losses, making it easier to file taxes later on. Since taxes can be tricky, especially for beginners, finding a platform that provides you with that information can make filing taxes less stressful.

One of the oldest platforms, founded in 2011, Kraken is also considered one of the best cryptocurrency exchanges. With over 60 cryptocurrencies and high cybersecurity ratings, Kraken also has relatively cheap trading fees and is great for more experienced traders. Centralized cryptocurrency exchanges act as an intermediary between a buyer and a seller and make money through commissions and transaction fees. You can imagine a CEX to be similar to a stock exchange but for digital assets. In order to start buying and selling cryptocurrencies and other digital assets, the most common way is to transact with Crypto Exchanges. Cryptocurrency exchanges are privately-owned platforms that facilitate the trading of cryptocurrencies for other crypto assets, including digital and fiat currencies and NFTs.

Different Types Of Cryptocurrency Investing

A cryptocurrency exchange is an online marketplace where users buy, sell, and trade cryptocurrency. Crypto exchanges work similar to online brokerages, as users can deposit fiat currency (such as U.S. dollars) and use those funds to purchase cryptocurrency. Users can also trade their cryptocurrency for other cryptocurrencies, and some exchanges allow users to earn interest on assets held within the exchange account.

- This is a little like having a credit score – whereby the banks trust an individual because they have built up credibility.

- With an emphasis on regulatory compliance, Forbes Digital Assets ranked the top 60 cryptocurrency exchanges in the world.

- While some offer only simple market orders, other exchanges will allow you to set more advanced order types, including limit and stop orders.

- That is undoubtedly safer when you know that funds you send are under state compliance instead of sending your funds “somewhere.”

- Some regions have banned transactions related to crypto assets, while others have imposed restrictions.

People with cryptocurrency wallets may receive cryptocurrency directly from a cryptocurrency exchange. Many of them can also convert digital currency balances into prepaid cards. On the other hand, you can look for a crypto broker since they can provide traders with derivatives products, allowing them to engage in contracts to trade on the value of cryptocurrencies.

In early 2022, Cash App’s CEO Jack Dorsey announced that the company has started to roll out support for the Bitcoin Lightning Network to enable near-instant Bitcoin transfers at almost no cost. We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Advantages Of Centralized Cryptocurrency Exchanges

Offering a solid range of coins with low fees, Kraken is well-suited for beginners. This exchange makes it easy to buy and sell with the Kraken Instant Buy platform. More advanced users can take advantage of lower fees with Kraken Pro, which charges a 0.16% maker fee and a 0.26% take fees for trades of $50,000 or less. BitYard is one of the few exchanges that complies with financial industry regulations and holds licenses in Australia, Singapore and the U.S. Users who are interested in spot trading will enjoy the low trading fees and a decent selection of popular cryptocurrencies.

The article discusses how to get started in cryptocurrency exchange development to create a new platform for trading different cryptocurrencies. Kraken’s professional-grade trading platform, Kraken Pro, is our pick for the best low-fee exchange because it charges some of the lowest fees in the crypto exchange landscape. It’s also our top choice for experienced traders, as it offers advanced order types and supports margin and futures trading. The best cryptocurrency exchanges make it easy to buy and sell the currencies you want with low fees and strong security features. Coinbase, for example, says it stores 98% of customer funds offline, while only 2% is actively traded. That storage, combined with its $255 million insurance policy, offers more reason to trust your crypto assets will be covered in the case of a hack.

Due to the range of interest rates or large returns offered by these exchanges, many cryptocurrency investors decide to park their money there. Are among the most attractive alternative investments for those seeking new opportunities. These digital currencies allow people to transfer funds online to purchase goods or services. Binance is a better fit for people familiar with cryptocurrency lingo and investing options, whereas Coinbase is built for convenient, easy trading. Buyers and sellers base their trade on the current cryptocurrencies’ market price.

How Do I Open A Crypto Exchange Account?

This is a little like having a credit score – whereby the banks trust an individual because they have built up credibility. In order to be allowed to exist and operate, a cryptocurrency exchange needs to adhere to the laws of the country. These laws differ from country to country but generally follow regulations related to the protection of the customer. “Once you become a little bit more savvy, you may want to move your coins somewhere else,” Ross says. Coinbase, for example, offers rewards for learning about new coins through its Coinbase Earn program. Others offer courses and articles on site to help you learn about crypto markets, history, and innovations, such as Gemini’s Cryptopedia or Binance Academy from Binance.

Keeping in mind all the required security procedures to avoid investment risks as much as possible, crypto trading is definitely something that needs to be administered by the right platform. That’s why taking your time to fully understand the workings of a crypto exchange is important before starting with the investment part. If you are a newcomer to the crypto space looking to start investing in crypto, ‘what is a crypto exchange? As you may gather from the title, what are crypto exchanges are platforms that allow users to buy, sell, and store cryptocurrency.

Moreover, exchanges are regularly offering new assets to expand their offering list. Suggest you open a crypto broker account, and we deposit 1,000 USD so we can sell Bitcoin. In case the price of BTC drops, we are benefiting from the difference at which we pull out of the trade. So, once the price drops from 1,000 USD to, let’s say, 600 USD, we take the 400 USD profit thanks to that difference.

What Are Privacy Coins? Everything You Need To Know

Signing up for a cryptocurrency exchange is a great way to get started investing in cryptocurrencies. Depending on the exchange, there may be additional steps you must complete, such as verifying your identity or providing a photo ID. Trading volumes are one of the main elements determining liquidity in the cryptocurrency market. To observe daily volumes, visit any website that lists the market capitalization of cryptocurrencies.