Contents:

If your child feels like your rules are breakable, they won’t have an incentive to stick to them. If something happens and you have to miss an important milestone, let your child know that you’re really sorry you missed it, and make it up to them with a special celebration. For instance, if you can’t take your child to class on the first day of school, you might celebrate by picking up their favorite dinner and a special dessert that night. Similarly, don’t make your child feel bad if it takes them a while to warm up to people, even if you’re very outgoing yourself. Don’t force them to be who you think they should be in order to earn your love. Let them know that you will always love them no matter what.

Using scientific knowledge is of course not a one-size-fits-all strategy. Even within the best parenting style, there can be many different effective parenting practices you can choose according to your child’s temperament. Stressed-out parents are more prone to fighting. Having some “me time” for self-care and stress management is important to rejuvenate the mind. Loving your child can be as simple as giving them hugs, spending quality time with them, having family meals together, and listening to your child’s problems seriously. So, be the person you want your child to be — respect your child, show them positive behavior and attitude, have empathy towards your child’s emotion — and your child will follow suit.

For example, the way your family celebrates Christmas, birthdays, and other special events are all examples of family rituals. Get into the mind-set that everything you do as a parent ultimately is part of validating or nurturing your children, especially during their teen years — preferably in ways they don’t consider offensive or embarrassing. Most of my blogs do focus on that in one way or another, but this week I just want to remind parents of how important they are, and to give them some props. It’s a job that gets so little in the way of public affirmation, and all to often, plenty of criticism when things go wrong.

What are the Hardest GCSEs? Should You Avoid or Embrace Them?

And many parents report that these strategies improve their children’s sleep patterns, as well as their own. But there are also parents who find the idea of letting a baby cry at night unduly harsh. Research tells us that to raise a self-reliant child with high self-esteem, it is more effective to be authoritative than authoritarian. You want your child to listen, respect and trust you rather than fear you. You want to be supportive, but not a hovering, helicopter parent.

- Quetsch and Cavell believe it’s important to maintain good physical health but put a large emphasis on tending to your emotional health, as well.

- This shows your children that adults mess up too.

- This will help your child develop the skills they need to work through future challenges more independently.

- Research tells us that to raise a self-reliant child with high self-esteem, it is more effective to be authoritative than authoritarian.

- Here’s what parents of successful kids have in common, according to research.

Avoid overly harsh forms of punishment, and never do anything that involves physically hurting your child—in addition to being abusive, it can actually make behavioral problems worse. Kids’ environments have an effect on their behavior, so you might be able to change that behavior by changing the environment. If you find yourself constantly saying “no” to your 2-year-old, look for ways to alter your surroundings so that fewer things are off-limits. This will cause less frustration for both of you.

How Adolescence Intensifies the Parent-Child Relationship

These positive experiences create good neural connections in your child’s brain and form the memories of you that your child carries for life. But if you can keep working on the tips in this parenting guide, you will still be moving in the right direction even though you may only do part of these some of the time. No child is perfect either … keeping this in mind is important when we set our expectations. While many people will try to give you parenting advice, realize that it’s ultimately your decision how you want to raise your child.

Being consistent with rules, consequences, and attention leads to well-behaved kids because if they expect that “bad” and “annoying” behavior will not work, then they will stop using those behaviors. A family routine is a systematic structure of behaviors that families use to organize and complete daily activities, spend time together and have fun. Every family has its own unique routines that serve that individual family’s passions, values, and beliefs.

- Catching them doing good and appreciating them for it is one of the most effective modern parenting techniques.

- After a number of years, he finally went for it.

- “We need to, from a very early age, teach kids what consent looks like,” Ms. Homayoun said.

- If something happens and you have to miss an important milestone, let your child know that you’re really sorry you missed it, and make it up to them with a special celebration.

To improve the level of online safety and protection given for children, the Family Zone parental app is being replaced with the world-leading Qustodio parental app. If you have more than one child – and statistics show 86 percent of families do – then managing screen-time can be double trouble. In the wake of the COVID pandemic, our children are facing a … And then there’s the matter of schoolwork – so much of which is online for even the youngest kids – not to mention the stubborn fact that different kids are just, well, different in how they are impacted by screens. Of course, girls need to be shown role models who give the lie to this misapprehension.

A Simple Guide to Succesful Parenting.

I’ve had to pick myself back up after making too many mistakes, and get going again. Yes, parenting is definitely the hardest job in the world. The ambivalent attitudes we have toward our children are simply a reflection of the ambivalent attitudes we have toward ourselves. All people are divided in the sense that they have feelings of warm self-regard as well as feelings of self-hatred and self-depreciation. Therefore, it is not surprising that parents would extend these same contradictory attitudes toward their offspring. Parents’ attitudes toward their children are a by-product of their fundamental conflicts and ambivalence toward themselves.

Toys can entertain your child for a while, but they will never let them feel loved and cared for as an attentive parent can. Instead, make time to take your child to do fun things—even something as simple as eating an ice cream cone in the park can create a sweet memory that will last much longer than any toy. Focus on the areas that need the most attention rather than trying to address everything all at once.

Dear Abby: Sounds of verbal abuse echo outside walls – Boston Herald

Dear Abby: Sounds of verbal abuse echo outside walls.

Posted: Mon, 24 Apr 2023 04:02:07 GMT [source]

Let your kids know that everyone makes mistakes and that you still love them, even when you don’t love their behavior. Praising accomplishments, however small, will make them feel proud; letting kids do things independently will make them feel capable and strong. By contrast, belittling comments or comparing a child unfavorably with another will make kids feel worthless. Remember, there is no right way of raising a child. Each child is different and so they require to be treated differently. There is no single answer to ‘how to be a good parent’ but we can look into some basics traits that you can acquire to become a good parent.

.By using this service, some information may be shared with YouTube.

Though I am the mother of two happy and driven entrepreneurial sons, these are questions I never thought to ask. Teach kids to be kind, respectful toward others, be charitable, grateful for what they have, and have empathy for others. Of course, we all want our kids to strive to get good grades, win awards and accolades for music, sports, and other activities, and be successful later in life. However, who they are as a person is more important than which awards they get. Of course, the characteristics of a good parent aren’t fixed or absolute. What may seem like good parenting to one person may not fit that definition for someone else.

During that dinner, he revealed that he viewed himself as a failure. When he asked why I thought that, I listed all of his attributes as a father. I told him whatever he did in business didn’t matter to me. The only thing I cared about was how he loved his family.

Parenting Hack: Activate Your Child’s C-Tactile Fibers

Their social skills develop quickly, which set the basis for when they venture into the world and go to school. They are experiential learners and test the boundaries of their bodies and minds. Guide your child as much as possible rather than prescribe. Encourage talking about their feelings and experiences.

Johnston County mom creates Facebook support group for parents … – WRAL News

Johnston County mom creates Facebook support group for parents ….

Posted: Mon, 24 Apr 2023 14:22:00 GMT [source]

They tend to develop a relationship with their kids. A 2007 meta-analysis of 35,000 preschoolers across the US, Canada, and England found that developing math skills early can turn into a huge advantage. Pulling from a group of over 14,000 children who entered kindergarten in 1998 to 2007, the study found that children born to teen moms were less likely to finish high school or go to college than their counterparts.

There are many better alternatives, e.g. redirection, reasoning, time-in, etc. You can choose a non-punitive discipline method that works best for your child. Parenting is one of the most researched fields in psychology. Many parenting techniques, practices, or traditions have been scientifically researched, verified, refined, or refuted. By shortcuts, I don’t mean shortchanging your child with tricks. What I mean is to take advantage of what is already known by scientists.

He pointed out that children need real parents who try really hard, but also mess up at times. Real parents love their kids AND can dislike them sometimes. Real parents need to be around their kids, and need to have a life of their own, too. Adolescence is a time for exploring many areas and doing new things.

According to research out of Harvard Business School, there are significant benefits for children growing up with mothers who work outside the home. A 2014 study lead by University of Michigan psychologist Sandra Tang found that mothers who finished high school or college were more likely to raise kids that did the same. One study found that, after divorce, when a father without custody has frequent contact with his kids and there is minimal conflict, children fare better. But when there is conflict, frequent visits from the father are related to poorer adjustment of children. While there are several factors that affect a child’s development, some of it comes down to parenting. Cavell encourages parents to have a “posture of discovery” when relating to their child.

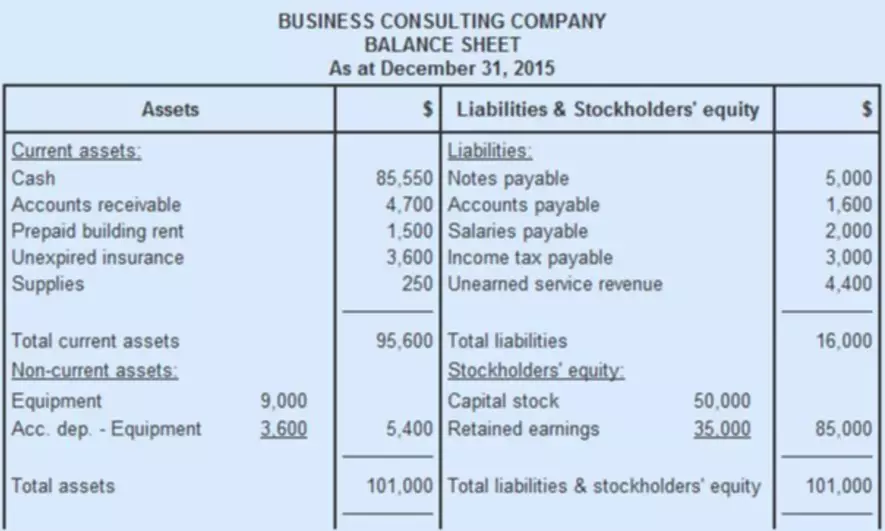

statement of stockholders equity who are too punitive can undermine the relationships between them and the child, but parents with too light a touch might lose the respect of their child. With every other undertaking in your life you probably have personal goals. With children, though, many parents only consider what they want their kids to accomplish. “Good Enough Parenting” acknowledges that parenting is not only difficult but surprising — and there are many times you’ll want to say, “I love my kids, but ….” What is a parent’s role in raising smart, confident and successful children?