Content

Similarly, there may be shareholders who trust the management potential and may prefer allowing them to retain the earnings in hopes of much higher returns . Positive profits give a lot of room to the business owner of the Company Management to utilize the surplus money earned. Often this profit is paid out to shareholders, but it can also be reinvested back into the company for growth purposes. Enter the beginning period retained earnings, cash dividends, and stock dividends into the calculator.

What is the sum of retained earnings?

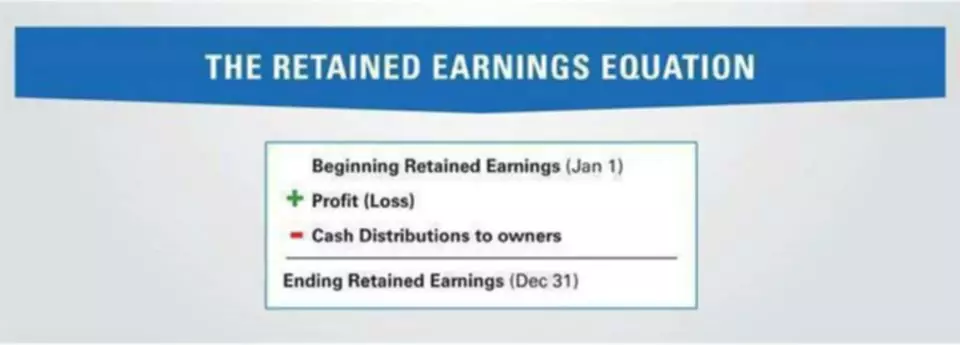

The retained earnings balance is the sum of total company earnings (net income) since inception, less all cash dividends paid since the firm's inception. Businesses can choose to accumulate earnings for use in the business, or pay a portion of earnings as a dividend.

You can find the beginning retained earnings on your Balance Sheet for the prior period. Examples of these items include sales revenue, cost of goods sold, depreciation, and other operating expenses.

Retained Earnings Explained

More specifically, retained earnings are the profits generated by a business that are not distributed to shareholders. For example, the earlier calculations resulted in answers of 11.6%, 11%, and 10%. As a result, we now have a more thorough approximation of the cost of retained earnings by averaging the results of the calculations provided in the examples. For example, if the bond’s interest rate is 6% and you assign a risk premium of 4%, add these together to get an estimate of 10% for the cost of retained earnings. Companies have four possible direct sources of capital for a business firm. They consist of retained earnings, debt capital, preferred stock, and new common stock. Many companies adopt a retained earning policy so investors know what they’re getting into.

- If they see progressive increases, the company’s current state of reinvesting retained earnings is considered effective.

- Financial statements are written records that convey the business activities and the financial performance of a company.

- There’s no long term commitment or trial period—just powerful, easy-to-use software customers love.

- Furthermore, if we wish to evaluate a business’s operations, as apart from they way it is financed, we would need to compute its Cashflow from Assets, as described above.

- After paying dividends to shareholders, the remaining money is held in reserve called the “retained earnings”.

- Keep in mind that if your company experiences a net loss, you may also have a negative retained earnings balance, depending on the beginning balance used when creating the retained earnings statement.

However, the most comprehensive approach is to calculate all three methods and use the average. Retained earnings belong to the shareholders since they’re effectively owners of the company.

Retained Earnings Calculator

Unless a business is operating at a loss, it generates earnings, which are also referred to as the bottom-line amount, profits or after-tax net income. It is January 18th, 2020 and the accounting department at ABC Inc. is hard at work preparing the financial statements for fiscal year 2019. The company has hired interns to help with the reporting process and you are mentoring Kayla, an intern in her 2nd undergraduate year. All of the amounts used by Kayla were obtained from the latest adjusted trial balance. Any changes or movement with net income will directly impact the RE balance. Factors such as an increase or decrease in net income and incurrence of net loss will pave the way to either business profitability or deficit.

The result is the company’s cumulative retained earnings for the current period. Management and shareholders may like the company to retain the earnings for several different reasons. In the long run, such initiatives may lead to better returns for the company shareholders instead of that gained from dividend payouts. https://simple-accounting.org/ Paying off high-interest debt is also preferred by both management and shareholders, instead of dividend payments. You can calculate the cost of retained earnings using the discounted cash flow method. Investors who buy stocks expect to receive two types of returns from those stocks—dividends and capital gains.

How to Create a Retained Earnings Statement

Retained earnings are mainly analyzed for evaluating the profits and focusing on generating the highest return for the shareholders. The statement of retained earnings records the activity in the retained earnings formula. Note that total asset balance ($185,000) equals the sum of total addition to retained earnings formula liabilities and equity, so the balance sheet equation is in balance. Custom has income that is not related to furniture production and sales. In 2020, the company sold a piece of machinery for a gain, and produced $2,000 in non-operating income, resulting in $28,500 income before taxes.

Global One Real Estate Investment : Summary of Financial Results for the Six-Month Period Ended September 2022 – Marketscreener.com

Global One Real Estate Investment : Summary of Financial Results for the Six-Month Period Ended September 2022.

Posted: Thu, 17 Nov 2022 07:49:08 GMT [source]